Dried fish processors of Karnataka

Dried fish processors of Karnataka

Amalendu Jyotishi, Ramachandra Bhatta, Prasanna Surathkal

Table of contents

Table of contents 1

Acknowledgements 1

1. Executive Summary 1

2. Introduction 2

3. Methodology 4

3.1. Planning for data collection 4

3.2. Fieldwork for data collection 5

3.3. Sampling design 7

4. Results 8

4.1. Demographic and socioeconomic profile of the respondents 8

4.2. Dried fish operations 14

4.2.1. Procurement of raw fish for dried fish operations 14

4.2.2. Major species/types of dried fish produced in Karnataka 17

4.2.3. Quantities of fresh/raw fish procured for dried fish operations 17

4.2.4. Number of days of fish drying 22

4.2. Capital costs in dried fish production 22

4.4. Working capital/variable costs in dried fish production 25

4.4. Losses in dried fish operations 25

4.5. Seasonality in dried fish production 28

4.6. Marketing of dried fish 28

4.7. Perceptions about the dried fish profession 33

4.8. Impacts of COVID-19 45

5. Discussion 47

6. Conclusions and Recommendations 49

7. Bibliography 52

List of Tables

Table 1. Number of fishers in the coastal districts of Karnataka. 2

Table 2. Share (percentage) of women in fisheries-related activities in the coastal districts of Karnataka. 3

Table 3. Number of survey respondents sampled, by type of landing center. 7

Table 4. Demographic characteristics of the respondents. 9

Table 5. Caste details of the respondents . 10

Table 6. Some characteristics of the livelihoods of the respondents. 11

Table 7. Household income and some related characteristics of the respondents. 12

Table 8. Household size of the respondents. 14

Table 9. Sources of fresh fish for dried fish operations. 15

Table 10. Sources of fresh fish used by respondents for dried fish operations, by type of landing center. 15

Table 11. Choice of fish for drying operations, as stated by the respondents. 17

Table 12. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the first survey (monsoon round). 19

Table 13. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the second survey (post-monsoon round). 20

Table 14. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the third survey (pre-monsoon round). 21

Table 15. Days required for drying fish, by species/fish type. 22

Table 16. Marketing channels used by respondents: No. of respondents using different channels. 29

Table 17. Usual mode of transportation used by respondents in direct sales of dried fish. 29

List of figures

Figure 1. Group discussions with women dried fish processors and traders on 16/06/2020. 5

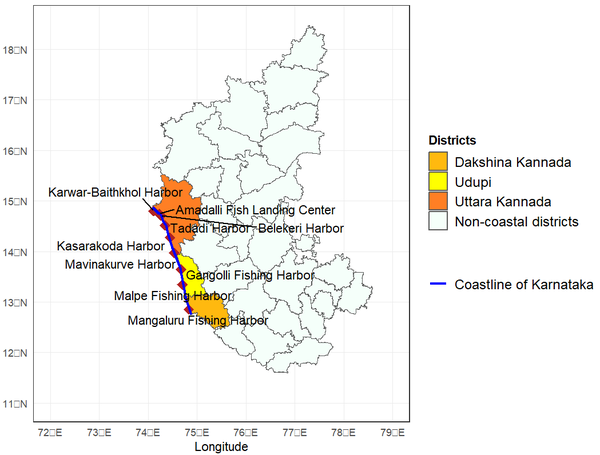

Figure 2. Map showing the nine fishing harbors of Karnataka. 6

Figure 3. Training of NETFISH Enumerators on data collection, sampling methods, ethics protocol on 4th July 2020. 7

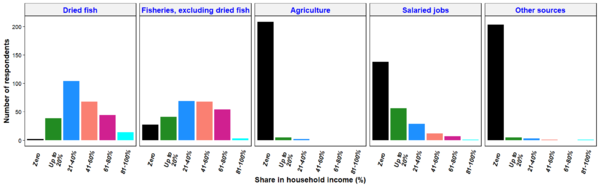

Figure 4. Major sources of household income of the respondents, and their share. 13

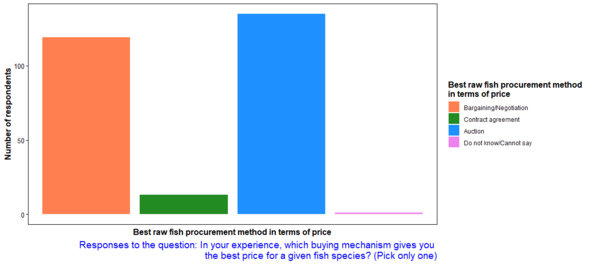

Figure 5. Best method for procuring raw fish for dried fish operations, as perceived by respondents. 16

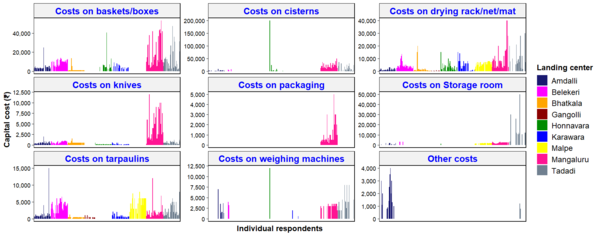

Figure 6. Capital costs of dried fish operations, by source of costs, and by landing center. 23

Figure 7. The fish drying yard adjacent to the Tadadi fishing harbor. 24

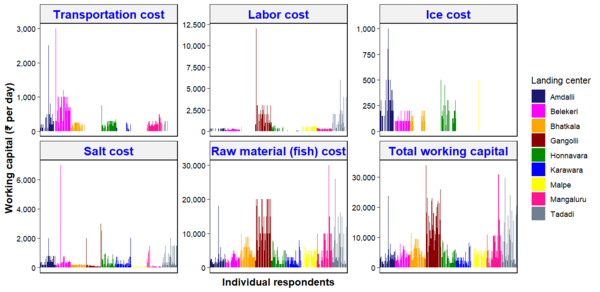

Figure 8. Working capital in dried fish operations, by source of costs, and by landing center. 26

Figure 9. Economic losses in dried fish operations, by source of loss, and by landing center 27

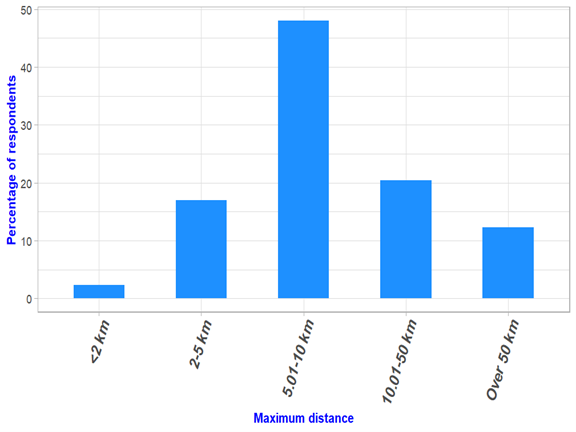

Figure 14. Direct selling of dried fish: maximum distance traveled by respondents for selling. 30

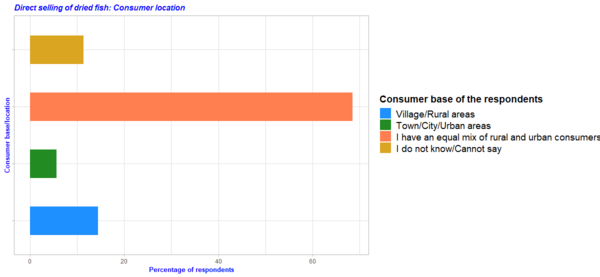

Figure 15. Direct selling of dried fish: location of consumers. 31

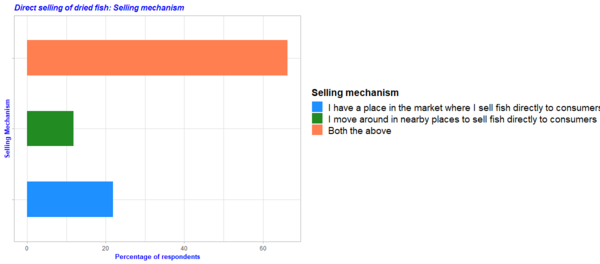

Figure 16. Direct selling of dried fish: selling mechanism. 32

Figure 17. A word cloud representing the most frequent words associated by consumers when they buy dried fish, as recalled by respondents. 33

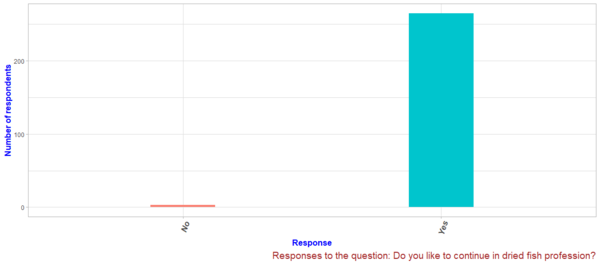

Figure 18. Willingness of the respondents to continue in dried fish profession. 34

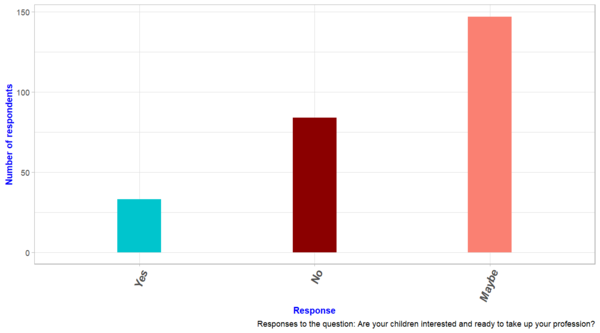

Figure 19. Perceptions of the respondents about the willingness of their children to continue in dried fish business. 34

Figure 20. Perception of the respondents about the willingness of the younger generation to take up dried fish business. 35

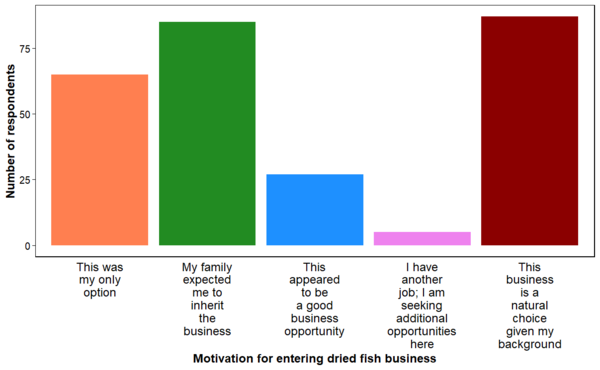

Figure 21. Motivation for the respondents to enter dried fish business. 36

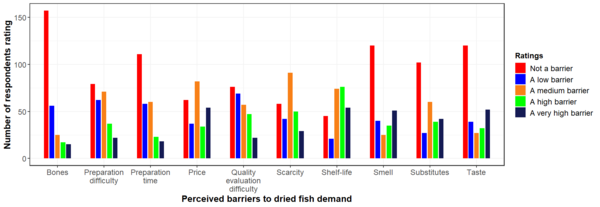

Figure 22. Barriers to the demand for dried fish and their ratings provided by the respondents. 37

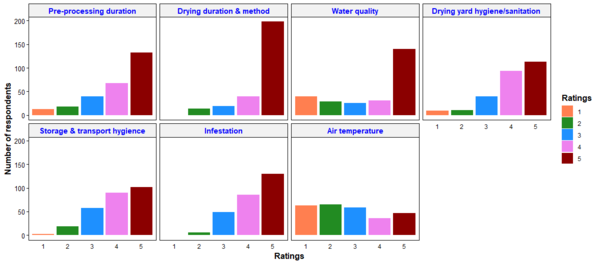

Figure 23. Perceptions of the respondents about some selected dry-processing quality variables and their importance. 38

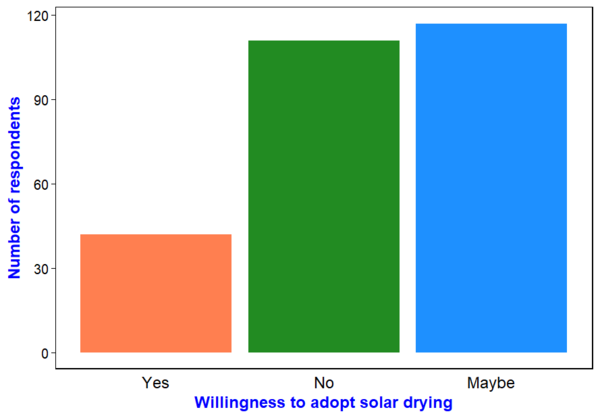

Figure 24. Willingness of the respondents to adopt solar drying. 39

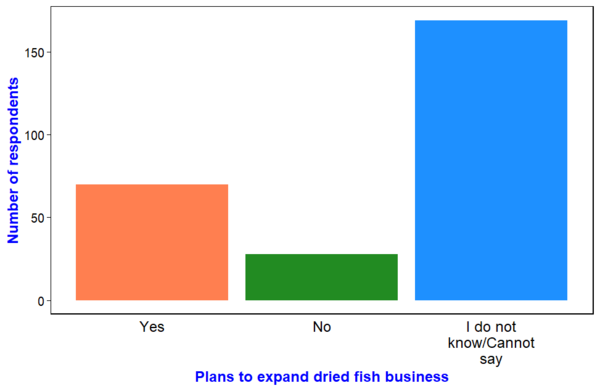

Figure 25. Willingness of the respondents to expand their dried fish business. 40

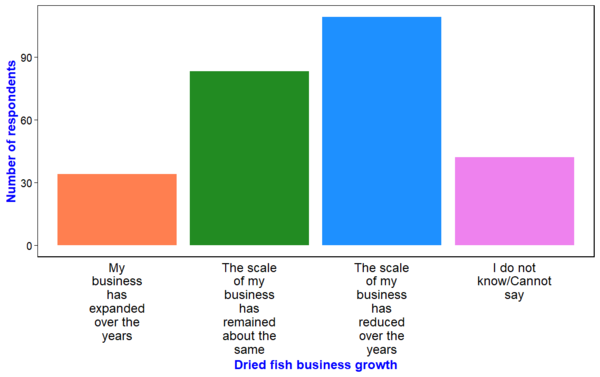

Figure 26. Perceptions of the respondents about the growth of their dried fish business over the years. 41

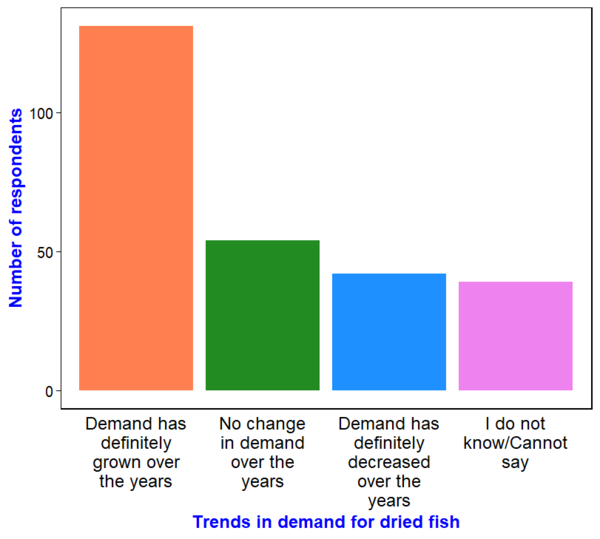

Figure 27. Perceptions of the respondents about trends in demand for dried fish over the years. 42

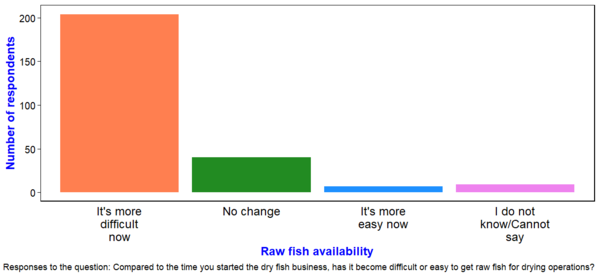

Figure 28. Perceptions of the respondents about the availability of raw fish over the years for dried fish operations. 43

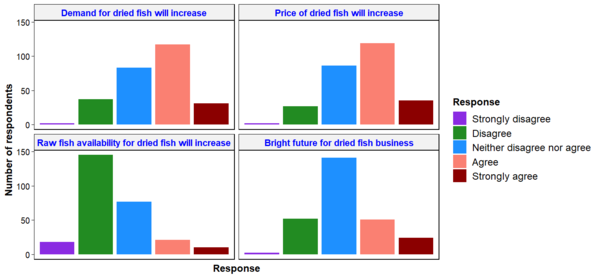

Figure 29. Perceptions of the respondents about the future of dried fish business. 44

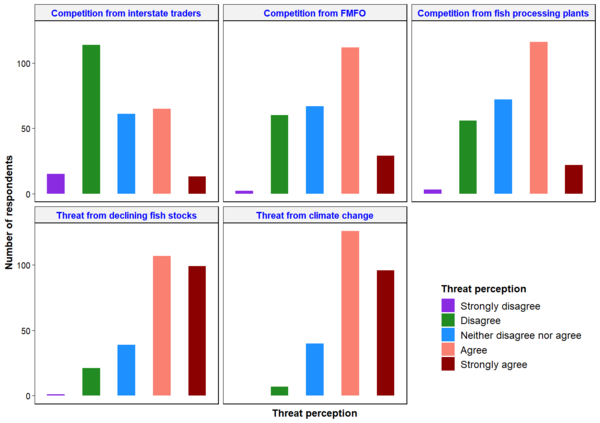

Figure 30. Perceptions of the respondents about some factors as a source of threat to their dried fish operations. 45

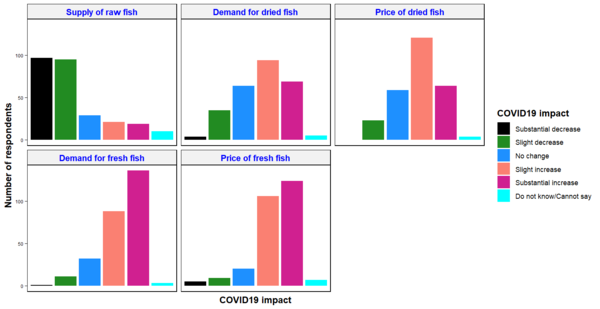

Figure 31. Impact of COVID-19 on fish processing operations. 46

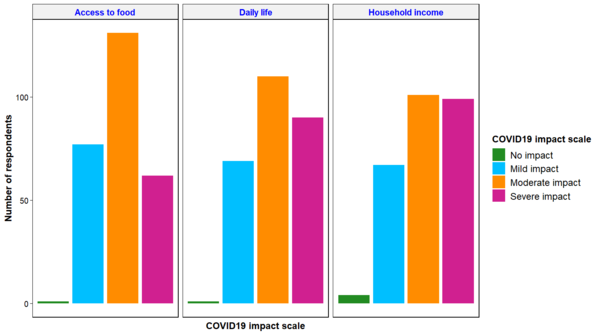

Figure 32. Impact of COVID-19 on some aspects of daily life of the respondents. 47

Acknowledgements

The authors thank the cooperation in data collection from NETFISH Karnataka state supervisor Mr. Narayana K.A., and the harbor data collectors Mr. Yashwin Bengre (Mangaluru), Ms. Shruthi Kunder (Malpe), Ms. Saraswathi (Gangolli), Ms. Pratiksha Kharvi (Mavinakurve Bhatkala), Ms. Alphonsa Fernandes (Kasarakoda, Honnavara), Mr. Santhosh H (Tadadi), Mr. Chetan Uday Naik (Belekeri), Mr. Sudheer Gouda (Amadalli) and Mr. Prashan Salaskar (Karwar Baithkhol).

The authors thank the Dried Fish Matters (DFM) project and the Social Sciences and Humanities Research Council (SSHRC) of Canada for the funding support. Support from Azim Premji University and Snehakunja Trust is duly acknowledged.

Executive Summary

Processing harvested marine fish into dried fish has been an age-old practice and by far the most common method of preserving fish on the Karnataka coast. Performed mostly by women of fisher communities in small-scale operations, dried fish processing and marketing are important traditional livelihood options on the coast. However, in the drive for modernizing the seafood sector, the dried fish segment has long gone out of favor among policymakers as well as academics despite possessing several advantages for both producers and consumers of dried fish. In this regard, this report sets out the goal of providing a detailed description of the dried fish processing segment in the Karnataka coast so as to gain a better appreciation for the role of the dried fish value chain in the regional economy. This report is a product of the only detailed study of dried fish production in Karnataka State.

The study collected primary data from dried fish processors in the three coastal districts of the state through structured interviews. A total of 271 processors were interviewed from around the nine major fishing harbors of the state. The respondents were interviewed thrice coinciding with the three major seasons in Karnataka marine fisheries, i.e., the monsoon season, post-monsoon season, and the pre-monsoon season. Through this approach, the study analyzes not only the seasonal patterns in dried fish production in the state, but also the relative size of dried fish production across the geographical markets and the major species used for processing. There were many questions that were repeated in every round of the survey, while some unique questions were included in each round to capture unique aspects of the value chain, for example impacts of the COVID-19 pandemic.

A key contribution of this study is its detailed socioeconomic and demographic profile of dried fish processors. The study also explains the operation of their dried fish businesses, and their perceptions of some of the major issues facing the dried fish segment of Karnataka’s seafood value chain. The findings demonstrate the predominant role played by women in dried fish value chains, supported by the fact that about 95 percent of the respondents were women. The study suggests seasonal patterns in dried fish processing such that largest procurements of fresh fish for dried fish operations occurred in the post-monsoon period, followed by the monsoon period, with the lowest procurements taking place in the pre-monsoon period. Mangaluru is the largest production market in terms of volume of fresh fish procured for dried fish operations. In terms of fish species, anchovies and mackerel are the two most procured fish in these production markets. The study examined the capital costs, working capital, losses during production and marketing, and the marketing channels for dried fish used by the processors. Results indicate the importance of dried fish not only as a livelihood option for coastal fisher communities, but also as a source of nutrition-dense food for the regional food systems of the state. Based on its findings, the report makes recommendations for policymakers and academicians that can help improve the dried fish processing segment of the state’s seafood value chain. The dried fish processing segment has been neglected for far too long despite holding tremendous potential to create livelihoods, improve nutritional security, and enhance fisheries sustainability.

Introduction

Karnataka is endowed with a 320 km long coast and a continental shelf area of 27,000 square km, exclusive economic zone of 87,000 square km. There are three districts in the coastal stretch of the state: Dakshina Kannada (62 km coastline), Udupi (98 km) and Uttara Kannada (160 km). Annual fish catch potential of the state’s marine waters is estimated to be 425,000 metric tons (Bhatta, Rao, and Nayak 2003). The three coastal districts in total have 156 fishing villages. Fishing and allied activities are sources of food, income, and livelihood to over 128,000 people in the three districts (Table 1). The state’s marine fisheries infrastructure consists of 8 harbors, 16 fish landing centers, and 91 beach landing points.

Table 1. Number of fishers in the coastal districts of Karnataka.

| District | Full-time fishers | Part-time fishers | Total |

|---|---|---|---|

| Dakshina Kannada | 2,584 | 1,804 | 4,388 |

| Udupi | 54,239 | 12,963 | 67,202 |

| Uttara Kannada | 33,184 | 23,484 | 56,668 |

| Total | 90,007 | 38,251 | 128,258 |

|

Data source: [1 Directorate of Fisheries, Government of Karnataka 2021]. | |||

Fisheries in Karnataka make substantial contributions in at least three domains: in creating livelihoods; as vital source of nutrition; and, in earning export revenues. Moreover, there is a strong gendered role in these livelihoods whereby women are mostly responsible for post-harvest processing and marketing in the fisheries value chain. This is evident from Table 2 which shows the share (percentage) of women in different fisheries-related occupations. These data help in gaining a preliminary understanding about the fisheries of the coastal districts of Karnataka that can guide, for example, better design of survey-sampling for studies on the socioeconomics of fisheries.

Fish is nutritious but also highly perishable, and hence needs to be processed and preserved to increase shelf-life. Salting/curing/drying of fish (henceforth referred to only as fish drying unless otherwise specified) is one of the most common preservation techniques practiced in the Karnataka coast. For centuries, it has been perhaps the most important traditional method of fish preservation practiced in coastal fishing villages of the state. It is arguably a more environmentally friendly preservation technology compared to other prominent fish preservation technologies, it does not require sophisticated setup for production and storage, and it produces a nutritionally dense product with a reasonable shelf-life that costs less in terms of cost per unit of nutrients than other available protein sources.

Though there are some studies such as [2, Bhatta and Rao 2003], [3, Bhatta, Rao and Nayak 2003], and [4, Viswanatha et al., 2015] that provide broader perspectives on Karnataka’s seafood processing sector, there is surprisingly scanty literature focused on the finer details of the fish processing sector of Karnataka, especially the fish drying segment. Thus, the contributions of fisherwomen, who are engaged in downstream activities including curing/processing and marketing in fisheries, are ignored. The dried fish segment of Karnataka has been ignored also on the policymaking front. There are no major government programs to support this small-scale fisheries activity. This appears to be a classic example for the Kannada proverb “ಹಿತ್ತಲ ಗಿಡ ಮದ್ದಲ್ಲ/Hittala gida maddalla”, meaning neglecting/missing the obvious remedy.

Table 2. Share (percentage) of women in fisheries-related activities in the coastal districts of Karnataka.

| District | Marketing | Net mending/ making | Curing/ Processing | Peeling | Laborer | Others | Total |

|---|---|---|---|---|---|---|---|

| Dakshina Kannada | 77 | 19 | 78 | 92 | 18 | 28 | 57 |

| Udupi | 80 | 24 | 42 | 93 | 33 | 29 | 64 |

| Uttara Kannada | 97 | 16 | 89 | 83 | 17 | 44 | 76 |

| Total | 89 | 20 | 62 | 92 | 25 | 32 | 68 |

Data source: The 2016 round of Marine Fisheries Census (MFC-2016) conducted by the Central Marine Fisheries Research Institute of India (CMFRI).

Given this context, the goal of this report is to provide a detailed description of the dried fish producers of Karnataka. The objectives of the study are to gain a better understanding of their socioeconomic and demographic profile, operational details during the different seasons (post-monsoon, monsoon, and pre-monsoon), and their perceptions about some of the major issues related to dried fish processing and fisheries. This report is a product of the only comprehensive study, at least in the last three decades, on the dried fish production segment of Karnataka. Though this report is intended for a general reader base, it is particularly useful for development practitioners to gain an informed understanding of dried fish producers of Karnataka to assist in better planning of schemes aimed at welfare of fishers of the state. The next section of this report describes the data collection procedure, followed by a section on the major findings, and then concludes with a summary of the study.

Methodology

Planning for data collection

The novel coronavirus pandemic of 2019 (COVID-19) was at its peak during the data collection period of the study. Therefore, it was necessary to adapt the data collection procedure given the severe restrictions on logistics and transportation services in India. Upon exploring options to collect data, an organization namely the Network for Fish Quality Management & Sustainable Fishing (NETFISH), was found to be suitable with extensive field expertise in collecting data from the fishing industry of coastal Karnataka. NETFISH is a society registered under the Marine Products Export Development Authority (MPEDA) of the Ministry of Commerce & Industry, Government of India. There are NETFISH staff, designated as the Harbor Data Collectors (HDCs), in all major fishing harbors of Karnataka, collecting data related to fish landings and other fisheries-related activities. Initial interactions with Mr. Narayana K.A., the state supervisor of NETFISH-Karnataka, provided the team with valuable inputs useful in data collection from along the Karnataka coast. An agreement was signed between NETFISH and the DFM-Karnataka team in which the responsibility of collecting primary data on dried fish production was entrusted with NETFISH. Partnership with NETFISH helped the Karnataka DFM team conduct surveys even when severe limitations were imposed on movement of people and goods during the novel coronavirus (COVID-19) pandemic.

Preliminary discussions (via focus group discussions, FGD) were held with dried fish producers to gain a better understanding of the dried fish sector. The FGDs took place in the premises of Snehakunja Trust, Honnavara, Uttara Kannada, on 16th June 2020 and attended by about 30 women dried fish processors[1]. The FGDs brought together nearby women processors and traders (Figure 1). The FGDs focused on topics including dried fish processing, procurement of raw materials, trading, species characteristics, processing typologies, characteristics of the households engaged in drying and the intricacies of transaction and other relational aspects. Inputs received in FGDs were used in the development of the questionnaire. The questionnaire was also reviewed by the Azim Premji University Institutional Review Board (IRB), which is responsible to oversee ethics in human research.

Figure 1. Group discussions with women dried fish processors and traders on 16/06/2020.

Given the lack of data on the dried fish segment of Karnataka, it was necessary to collect primary data for achieving the goals of the study. Since dried fish production takes place throughout coastal Karnataka, appropriate data collection procedures needed to be developed. The 300 km Karnataka coast is divided into nine fishing harbors which are the first stage of stratification. The nine harbors selected for data collection are: Karwar-Baithkhol, Amadalli, Belekeri, Tadadi, Kasarakode/Honnavara, and Mavinakurve/Bhatkala (in Uttara Kannada district); Gangolli and Malpe (in Udupi district); and Mangaluru in Dakshina Kannada district. Figure 2 shows the location of the nine fish landing centers where the dried fish processors were interviewed.

Fieldwork for data collection

A one-day training was held for the HDCs on July 4th 2020 regarding administering the questionnaire and data entry in tablet/smartphone (Figure 3). Three rounds of structured survey were conducted. After the completion of each round of the survey, a meeting was held with the enumerators/HDCs to receive feedback about the completed surveys and to identify any scope for improvement in survey administration. The questionnaires were transformed to be compatible for use with Google® Forms®.

The first round of data collection was planned during July 10, 2020 and to be completed by August 30, 2020 that would correspond with the monsoon season. The second round of survey was carried out in December-January 2020-21 (post-monsoon season), and the third round of survey in the pre-monsoon months of April-May 2021 (but extended up to June due to COVID-19 related disruptions). Apart from questions that were repeated in every round of the survey, there were also some unique questions in each round that were designed to capture specific constructs. For example, in the third round there were questions aimed at capturing the entrepreneurial motivations of the dried fish processors.

Figure 2. Map showing the nine fishing harbors of Karnataka.

Figure 3. Training of NETFISH Enumerators on data collection, sampling methods, ethics protocol on 4th July 2020.

Sampling design

Two types of production points were identified: fishing harbors (or fish landing centers), which are larger in area and used for docking mechanized fishing boats, and beach landing points (or beach landing centers) which are much smaller in area and used for docking traditional fishing boats. Beach landing centers are important as they represent the small-scale fisheries of coastal Karnataka. In total, 48 of the 271 interviewees were located in beach landing centers while the rest (223) were in fishing harbors (Table 3). Given the absence of a comprehensive sampling frame of dried fish producers, the study used a convenience sampling technique to draw the respondents from the population of dried fish producers at each landing center.

Table 3. Number of survey respondents sampled, by type of landing center.

| Location | Beach Landing Center | Harbor | Total |

|---|---|---|---|

| Amdalli | 17 | 13 | 30 |

| Belekeri | 5 | 25 | 30 |

| Bhatkala | 6 | 24 | 30 |

| Karawara | 19 | 11 | 30 |

| Tadadi | 1 | 29 | 30 |

| Gangolli | 0 | 31 | 31 |

| Honnavara | 0 | 30 | 30 |

| Malpe | 0 | 30 | 30 |

| Mangaluru | 0 | 30 | 30 |

| Total | 48 | 223 | 271 |

Results

Demographic and socioeconomic profile of the respondents

Table 4 shows the demographic characteristics of the respondents. Almost 96 percent of the respondents were women. This is higher than the numbers on the curing/processing activities in the coastal districts taken from the 2016 Marine Fisheries Census conducted by the Central Marine Fisheries Research Institute (MFC-2016) in Table 2. Since the sampling design of this study focused only on the dried fish processors whereas MFC covers all marine fishers, the results imply that the dried fish processing activities are predominantly carried out by women. In terms of the age distribution there are very few processors in the 18-30 age group. The majority of the processors are 40 years or older. Regarding religion, about 94 percent of the respondents are Hindus, four percent are Muslims, and one percent are Christians. In comparison, MFC-2016 shows that the marine fisher population of coastal districts consists of 89 percent Hindus, 10 percent Muslims, and one percent Christians.

In terms of the caste profile of the sample, Table 4 shows that 65 percent of the respondents belong to the Other Backward Class (OBC) category, 30 percent belong to the General category, and about five percent belong to the Scheduled Castes (SC) and Scheduled Tribes (ST). In comparison, MFC-2016 shows the number of SC/ST populations among fishers, and accordingly about 9 percent of the total marine fisher population of coastal Karnataka belongs to SC/ST communities. MFC-2016 does not provide details about other castes.

With respect to educational qualifications, Table 4 shows that about 19 percent of the respondents did not receive any formal education, 61 percent completed primary schooling (up to grade 7), 18 percent completed high-school (up to grade 10), and three percent completed Pre-University Certificate (PUC, 12th Grade), while none completed undergraduate education. In comparison, MFC-2016 does not explicitly report the number of fishers who did not receive formal education. The Table 4 in MFC-2016 shows that about 41 percent of total marine fishers of coastal Karnataka completed primary schooling, 41 percent completed high-school, 12 percent completed PUC, and 6 percent completed graduation[2].

Table 4. Demographic characteristics of the respondents.

| Characteristic | Category | Percentage of respondents |

| Gender | Female | 95.9 |

| Male | 4.1 | |

| Age group | 18-30 | 0.4 |

| 30-39 | 19.0 | |

| 40-49 | 33.2 | |

| 50-59 | 32.1 | |

| 60-69 | 12.3 | |

| 70 or over | 3 | |

| Religion | Hinduism | 94.4 |

| Islam | 4.1 | |

| Christianity | 1.5 | |

| Caste grouping | General category | 30.1 |

| Other Backward Class | 65.4 | |

| Scheduled Castes | 3.3 | |

| Scheduled Tribe | 0.4 | |

| Others | 0.7 | |

| Educational level | No formal schooling | 19.3 |

| Primary school | 61.9 | |

| High school | 17.8 | |

| Pre-University Certificate (PUC) | 1.1 |

Table 5 shows the caste details of the respondents. The sample includes more respondents from the Kharvi, Mogaveera/Marakala/Moger, and Harikanthra castes. These are the major fishing communities of the coastal districts. The Kharvi and Harikanthra communities mostly reside in Uttara Kannada, whereas the Mogaveera/Marakala/Moger community is more common in Udupi and Dakshina Kannada districts.

Table . Caste details of the respondents .

| Amdalli | Belekeri | Bhatkala | Gangolli | Honnavara | Karawara | Malpe | Mangaluru | Tadadi | Total | Ambiga | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | Ankolekar | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | Banavalikar | 0 | 10 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10 | Bandari | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | Christian | 0 | 0 | 0 | 0 | 4 | 0 | 0 | 0 | 0 | 4 | Daarji (Muslim) | 1 | 0 | 0 | 0 | 9 | 0 | 0 | 0 | 2 | 12 | Gabit | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 7 | Golekar | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | Harikanthra | 28 | 0 | 0 | 0 | 0 | 7 | 0 | 0 | 9 | 44 | Kharvi | 1 | 12 | 20 | 31 | 2 | 23 | 0 | 0 | 5 | 94 | Kudtalkar | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | Kurle | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | Mestha | 0 | 0 | 0 | 0 | 14 | 0 | 0 | 0 | 0 | 14 | Mogaveera/

Marakala/ Moger |

0 | 0 | 10 | 0 | 0 | 0 | 30 | 30 | 0 | 70 | Mudgekar | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | Nilankar | 0 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | Saarang | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | Scheduled castes | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | Surangekar | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | Tandel | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | Total | 30 | 30 | 30 | 31 | 30 | 30 | 30 | 30 | 30 | 271 |

|---|

Table 6 shows some of the important characteristics of the respondents in terms of their livelihood and occupation. Fisheries-related activities are the main source of livelihood for over 90 percent of the respondents. These activities are the following: processing of dried fish (about 52 percent of the respondents); fishing (24 percent); and fresh fish marketing (17 percent). Only about 7 percent of the respondents cited non-fisheries activities to be the major source of their livelihood. Most of the respondents have at least 6 years of work experience in dried fish processing. The respondents were asked regarding which of the activities, i.e., selling of either dried fish or fresh fish, has better potential of earning higher income. About 57 percent of respondents believe that selling fresh fish has more potential in earning money, compared to selling dried fish.

Table 6. Some characteristics of the livelihoods of the respondents.

| Characteristic | Category | Percentage of respondents |

| Most important source of livelihood | Dried fish processing | 51.7 |

| Fishing | 24.4 | |

| Fresh fish marketing | 16.6 | |

| Household work | 1.1 | |

| Others | 6.3 | |

| No. of years of work experience in dried fish operations | 5 years or less | 10.3 |

| 6-15 years | 52.4 | |

| 16-30 years | 26.6 | |

| 31 years or more | 10.7 | |

| Activity with better earning potential | Dried fish marketing | 43.2 |

| Fresh fish marketing | 56.8 |

Table 7 shows the distribution of monthly household income for the respondents. Slightly over 80 percent of the respondents have incomes of ₹20,000 or less per month. Table 7 next shows the type of ration card possessed by the respondents, a commonly used measure of a household’s poverty. The Below Poverty Line (BPL) indicator is used by the Government of India to identify economic disadvantage. Only about 5 percent of the respondents hold the Above Poverty Line (APL) ration card, while 95 percent of the respondents hold the BPL card.

In comparison, MFC-2016 shows that about 84 percent of the marine fisher population in the three coastal district possessed a BPL card. District-wise, MFC-2016 shows that the share of BPL status in the marine fisher population was about 36 percent in Dakshina Kannada, 85 percent in Udupi, and 94 percent in Uttara Kannada. In our survey, the proportion of respondents with a BPL card in each landing centers is as follows: 100 percent in Amdalli, Belekeri, Bhatkala, Karawara (all in Uttara Kannada) and Gangolli (Udupi); 97 percent in Honnavara (Uttara Kannada); 90 percent in Tadadi (Uttara Kannada); 83 percent in Mangaluru (Dakshina Kannada); and 73 percent in Malpe (Udupi). Thus, in all the sampled landing centers excepting Malpe, the proportion of BPL card holders among dried fish processors is higher than that in respective district-wise general marine fisher population.

Table 7 also presents the type of housing owned by the respondents. Except for six respondents, all owned a house. About 76 percent of respondents owned a house with a tiled roof, and 18 percent owned a house with a concrete roof. These two types of housing can be considered as pucca houses (durable dwellings) in the Indian context. Other respondents owned a house with thatched roof or makeshift or katcha house. Though the MFC-2016 data do not reveal if the fishers own a house or not, they show that 93 percent of marine fishers in the three districts reside in pucca houses. The corresponding number for dried fish processors from our survey is close at 94 percent.

Table 7. Household income and some related characteristics of the respondents.

| Indicator | Category | Percentage of respondents |

| Monthly total income of the household | Below ₹10,000 | 32.1 |

| ₹10,001 to ₹20,000 | 49.6 | |

| ₹20,001 to ₹30,000 | 14.2 | |

| ₹30,001 to ₹40,000 | 4.1 | |

| Type of ration card | APL | 5.2 |

| BPL | 94.8 | |

| Type of housing | Do not own a house | 2.2 |

| Thatched/make-shift | 2.6 | |

| Concrete roof | 18.9 | |

| Tiled roof | 76.3 |

Figure 4 shows the sources of income and their share in total income of respondents’ households. The figure shows that fisheries activities, i.e., dried fish operations and non-dried fish activities, are the major sources of income for most of the respondents. Salaried jobs are sources of income for a limited number of households, but agriculture (defined to livestock) and “other sources” do not contribute much to the households’ income.

Figure 4. Major sources of household income of the respondents, and their share.

Table 8 shows the household size of the respondents in terms of total number of members in the household. There are some single respondents, and there are a few larger households (with 10 members or more). About 70 percent of the households have from three to six members.

Table 8. Household size of the respondents.

| Household size | No. of households | Percentage |

| 1 | 10 | 3.7 |

| 2 | 24 | 8.9 |

| 3 | 45 | 16.6 |

| 4 | 72 | 26.6 |

| 5 | 46 | 17.0 |

| 6 | 26 | 9.6 |

| 7 | 13 | 4.8 |

| 8 | 15 | 5.5 |

| 9 | 9 | 3.3 |

| 10 | 4 | 1.5 |

| 11 | 3 | 1.1 |

| 13 | 2 | 0.7 |

| 14 | 1 | 0.4 |

| 15 | 1 | 0.4 |

| Grand Total | 271 |

4.2. Dried fish operations

4.2.1. Procurement of raw fish for dried fish operations

It is not uncommon for the respondents to depend on multiple sources while procuring raw fish for dried fish operations (Table 9). Out of the 271 respondents, 104 people stated that they may make use of more than one source for procuring raw fish. Procurement through auctions and buying directly from boat owners at landing centers are the two most common sources of raw fish.

Table 9. Sources of fresh fish for dried fish operations.

| Source of fresh fish | No. of respondents using |

|---|---|

| Participating in auctions | 161 |

| Buying directly from boat owners at landing centers | 142 |

| Harvested by family members | 52 |

| Through commission agents | 36 |

| Buyback from traders at fixed price | 3 |

Table 10 shows some differences between the beach landing centers and fishing harbors in terms of sourcing of raw fish. For example, those located in a fishing harbor tend to depend more on direct buying from boats and on auctions, with these two sources combined being used by about 84 percent of all respondents for dried fish operations. In comparison, respondents from beach landing centers have more diversified sources of raw fish. In particular, auctions are relatively less important in beach landing centers.

Table 10. Sources of fresh fish used by respondents for dried fish operations, by type of landing center.

| Source of raw fish |

Percentage of respondents |

Beach Landing Center | Harbor | |

|---|---|---|---|---|

| Through commission agents | 28 | 4 | ||

| Participating in Auctions | 16 | 48 | ||

| Buyback from traders at fixed price | 0 | 1 | ||

| Harvested by family members | 20 | 11 | ||

| Buy directly from boat owners at landing centers | 36 | 36 | ||

Figure 5 shows the responses to the question on the best mechanism to buy fresh or raw fish for dried fish operations. Auction seems to be the best method according to the respondents. However, anecdotal observations indicate that in recent years the share of auctions as a procurement method has been declining, especially in the major fishing harbours.

Figure 5. Best method for procuring raw fish for dried fish operations, as perceived by respondents.

4.2.2. Major species/types of dried fish produced in Karnataka

In each round of the survey, respondents were asked to name six varieties of fish that they dried, followed by questions on the months of procuring those fish, quantity (i.e., number of baskets of raw fish) procured, and the number of days of drying[3]. Anchovy is the most frequently used type of fish for drying purposes, followed by the Indian mackerel, mixed varieties of fish, and croaker. It can also be seen that the frequencies of choosing of anchovies and mackerel are substantially higher compared to other fish types, indicating the popularity of these two fish types among the processors.

Table 11. Choice of fish for drying operations, as stated by the respondents.

| Fish species/type |

Number of respondents choosing the fish type |

First survey (Monsoon) | Second survey (post-monsoon) | Third survey

(pre-monsoon) | ||

|---|---|---|---|---|---|---|

| Anchovy | 310 | 259 | 283 | |||

| Mackerel | 178 | 253 | 188 | |||

| Mixed varieties | 127 | 98 | 74 | |||

| Croaker | 126 | 103 | 80 | |||

| Hilsa | 60 | 64 | 58 | |||

| Flatfish | 58 | 48 | 23 | |||

| Lizardfish | 56 | 13 | 32 | |||

| Scad | 51 | 98 | 45 | |||

| Ribbonfish | 34 | 43 | 67 | |||

| False trevally | 32 | 27 | 5 | |||

| Shrimp | 24 | 38 | 24 | |||

| Ponyfish | 23 | 32 | 5 | |||

| Trevally | 10 | 12 | 17 | |||

| Others | 25 | 41 | 30 | |||

4.2.3. Quantities of fresh/raw fish procured for dried fish operations

Table 12 shows the species-wise quantities/volumes of raw fish procured for dried fish operations in the post-monsoon round of the survey in the nine locations. Quantity/volume here refers to the number of baskets of fresh fish[4]. Landing centers are arranged from left to right in the descending order of total quantities procured. That is, the largest quantities of fresh fish procurement took place in Mangaluru whereas the least volume of raw fish was procured in Amdalli. Mangaluru accounts for about 36 percent of all fresh fish procured. In terms of species, anchovies occupy the top position with about a 28 percent share in total procurements. Mackerel (16 percent), mixed varieties (14 percent), flatfish (11 percent), scads (8 percent) occupy the subsequent ranks, while types such as croakers and lizardfish have a share of about 5 percent.

Table 13 shows the species-wise quantities of raw fish procured for dried fish operations at the nine locations in the monsoon round of the survey. Mangaluru again ranks first in terms of quantities (i.e., no. of baskets) procured for dried fish operations with about 33 percent share in total procurements. Karawara (16 percent), Tadadi (12 percent) occupy the next ranks. In terms of most procured fish type, mackerel occupies the first rank with a 31 percent share, followed by anchovy (20 percent), scads (16 percent).

Table 14 shows the species-wise quantities of raw fish procured for dried fish operations at the nine locations in the pre-monsoon round of the survey. Even in this round, Mangaluru occupies the first position in terms of most quantities of fresh fish procured with a share of 29 percent in total procurements, followed by Malpe (26 percent), Gangolli (14 percent), and Bhatkala (10 percent). In terms of species, anchovies occupy the first rank with a 41 percent share in total procurements, followed by mackerel (24 percent). The remaining types of fish have less than a 10 percent share in total procurements.

Table 12. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the first survey (monsoon round).

| Fish type | Mangaluru | Honnavara | Malpe | Gangolli | Belekeri | Tadadi | Karawara | Bhatkala | Amdalli | Total baskets |

|---|---|---|---|---|---|---|---|---|---|---|

| Anchovy | 2,085 | 1,638 | 1,485 | 1,484 | 991 | 328 | 99 | 874 | 124 | 9,108 |

| Mackerel | 3,060 | 513 | 445 | 307 | 361 | 155 | 152 | 38 | 46 | 5,077 |

| Mixed varieties | 0 | 2,059 | 725 | 212 | 0 | 518 | 691 | 288 | 54 | 4,547 |

| Flatfish | 2,531 | 0 | 600 | 403 | 0 | 25 | 0 | 10 | 5 | 3,574 |

| Scad | 2,150 | 0 | 0 | 420 | 0 | 75 | 2 | 0 | 63 | 2,710 |

| Croaker | 105 | 473 | 90 | 210 | 160 | 312 | 52 | 210 | 104 | 1,716 |

| Lizardfish | 90 | 362 | 665 | 0 | 0 | 366 | 0 | 47 | 0 | 1,530 |

| Ribbonfish | 810 | 85 | 50 | 0 | 0 | 47 | 2 | 18 | 13 | 1,025 |

| Shrimp | 0 | 30 | 0 | 0 | 0 | 0 | 627 | 0 | 34 | 691 |

| Hilsa | 0 | 0 | 0 | 0 | 461 | 0 | 44 | 29 | 109 | 643 |

| Others | 215 | 2 | 40 | 92 | 0 | 30 | 0 | 8 | 12 | 399 |

| Sardine | 398 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 398 |

| False trevally | 15 | 0 | 140 | 30 | 189 | 8 | 0 | 7 | 2 | 391 |

| Ponyfish | 15 | 0 | 0 | 0 | 14 | 40 | 5 | 0 | 43 | 117 |

| Total, all species | 11,474 | 5,162 | 4,240 | 3,158 | 2,176 | 1,904 | 1,674 | 1,529 | 609 | 31,980 |

Table 13. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the second survey (post-monsoon round).

| Fish type | Mangaluru | Karawara | Tadadi | Belekeri | Honnavara | Malpe | Amdalli | Gangolli | Bhatkala | Total baskets |

|---|---|---|---|---|---|---|---|---|---|---|

| Mackerel | 2,595 | 2,408 | 987 | 607 | 529 | 445 | 415 | 452 | 298 | 8,736 |

| Anchovy | 1,637 | 165 | 659 | 453 | 499 | 770 | 159 | 1,169 | 75 | 5,586 |

| Scad | 2,430 | 897 | 23 | 665 | 0 | 0 | 672 | 0 | 0 | 4,687 |

| Flatfish | 1,700 | 0 | 0 | 0 | 0 | 260 | 11 | 0 | 200 | 2,171 |

| Mixed varieties | 0 | 139 | 859 | 0 | 614 | 0 | 94 | 90 | 28 | 1,824 |

| Croaker | 20 | 81 | 360 | 154 | 173 | 195 | 145 | 0 | 53 | 1,181 |

| Hilsa | 0 | 110 | 101 | 445 | 14 | 0 | 126 | 0 | 65 | 861 |

| Ribbonfish | 670 | 10 | 63 | 0 | 30 | 0 | 26 | 0 | 36 | 835 |

| Queenfish | 0 | 627 | 25 | 0 | 0 | 0 | 17 | 0 | 98 | 767 |

| Shrimp | 0 | 91 | 40 | 0 | 217 | 0 | 61 | 0 | 0 | 409 |

| False trevally | 20 | 46 | 26 | 41 | 0 | 175 | 37 | 0 | 0 | 345 |

| Ponyfish | 5 | 53 | 36 | 176 | 0 | 35 | 22 | 0 | 0 | 327 |

| Others | 229 | 2 | 24 | 0 | 44 | 0 | 0 | 0 | 14 | 313 |

| Trevally | 15 | 0 | 35 | 0 | 98 | 0 | 0 | 0 | 2 | 150 |

| Moonfish | 0 | 0 | 84 | 0 | 0 | 30 | 22 | 0 | 5 | 141 |

| Lizardfish | 55 | 10 | 0 | 0 | 56 | 0 | 0 | 0 | 0 | 121 |

| Total, all species | 9,376 | 4,639 | 3,322 | 2,541 | 2,274 | 1,910 | 1,807 | 1,711 | 874 | 28,454 |

Table 14. Species-wise quantities (no. of baskets) of raw fish procured at the nine landing centers for dried fish operations, as reported in the third survey (pre-monsoon round).

| Fish type | Mangaluru | Malpe | Gangolli | Bhatkala | Tadadi | Honnavara | Karawara | Amdalli | Belekeri | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Anchovy | 1,110 | 2,803 | 2,574 | 696 | 495 | 376 | 46 | 81 | 106 | 8,287 |

| Mackerel | 1,810 | 2,026 | 0 | 360 | 288 | 137 | 208 | 64 | 63 | 4,956 |

| Scad | 1,195 | 10 | 0 | 60 | 15 | 0 | 68 | 0 | 1 | 1,349 |

| Ribbonfish | 695 | 0 | 0 | 190 | 85 | 55 | 52 | 4 | 18 | 1,099 |

| Mixed varieties | 105 | 0 | 339 | 435 | 448 | 241 | 4 | 7 | 0 | 1,579 |

| Flatfish | 290 | 0 | 0 | 50 | 15 | 0 | 0 | 0 | 0 | 355 |

| Lizardfish | 290 | 20 | 0 | 80 | 122 | 7 | 0 | 0 | 7 | 526 |

| Croaker | 225 | 0 | 25 | 97 | 234 | 250 | 39 | 20 | 20 | 910 |

| Trevally | 0 | 250 | 0 | 2 | 5 | 15 | 7 | 0 | 0 | 279 |

| Squilla | 0 | 0 | 0 | 0 | 160 | 0 | 0 | 0 | 0 | 160 |

| Hilsa | 120 | 0 | 0 | 0 | 0 | 5 | 87 | 98 | 53 | 363 |

| Horse mackerel | 0 | 0 | 10 | 0 | 0 | 115 | 0 | 0 | 0 | 125 |

| Shrimp | 0 | 0 | 15 | 0 | 0 | 114 | 23 | 3 | 0 | 155 |

| Others | 155 | 0 | 0 | 24 | 44 | 29 | 60 | 2 | 0 | 314 |

| Total, all species | 5,995 | 5,109 | 2,963 | 1,994 | 1,911 | 1,344 | 594 | 279 | 268 | 20,457 |

4.2.4. Number of days of fish drying

Table 15 shows the maximum, minimum, average, and mode (most frequently stated) number of days of drying for different fish types. Usually, it takes 2-8 days to dry the fish. Of course, the number of days of drying depends on other factors such as the climatic conditions and the size of fish species.

Table 15. Days required for drying fish, by species/fish type.

| Fish type | Maximum | Minimum | Mean | Mode |

|---|---|---|---|---|

| Anchovy | 8 | 2 | 3 | 4 |

| Mackerel | 8 | 2 | 5 | 4 |

| Croaker | 8 | 2 | 4 | 4 |

| False trevally | 8 | 2 | 5 | 6 |

| Flatfish | 4 | 2 | 3 | 2 |

| Hilsa | 6 | 3 | 4 | 4 |

| Lizardfish | 6 | 2 | 3 | 4 |

| Mixed varieties | 5 | 2 | 3 | 4 |

| Pomfret | 3 | 3 | 3 | 3 |

| Ponyfish | 5 | 2 | 3 | 3 |

| Pufferfish | 5 | 5 | 5 | 5 |

| Reef cod | 6 | 5 | 6 | 5 |

| Ribbonfish | 8 | 2 | 4 | 3 |

| Saraswathi | 3 | 3 | 3 | 3 |

| Sardine | 5 | 3 | 4 | 4 |

| Scad | 8 | 2 | 4 | 5 |

| Shark | 4 | 3 | 4 | 3 |

| Shrimp | 6 | 2 | 3 | 3 |

| Trevally | 6 | 3 | 5 | 4 |

| Tuna | 4 | 3 | 4 | 4 |

| Whitefish | 3 | 3 | 3 | 3 |

Capital costs in dried fish production

Dried fish production, in the current state of practice in the three districts, does not involve substantial capital investments especially when compared to other common fish preservation technologies such as freezing and canning. The respondents were asked about their investments in terms of necessary capital including the following: baskets/boxes; cisterns; drying rack/mat/net; knives; packaging; storage room; tarpaulins; weighing machines; and other items. Figure 6 shows the landing center-wise responses in terms of monetary value (₹) for each capital item. Each plot (facet) in the figure has different scale on the y-axis for cost (₹). Most common capital costs among dried fish processors are those on baskets/boxes, drying rack/net/mats, knives, and tarpaulins. Overall, larger capital costs on many of these items are observed in Mangaluru, which could be due to the higher production seen there. It could also be due to the relatively higher cost of living in Mangaluru.

Figure 6. Capital costs of dried fish operations, by source of costs, and by landing center.

Moreover, drying is performed mostly on public land that may be either common property or land taken on lease from government agencies. On average, the lessees pay an amount of about ₹2,000 per month as lease for the drying yard, which increases annually over the lease period by about 5 percent per annum. The Tadadi fishing harbor has a dedicated fish drying yard managed by the Karnataka Fisheries Development Corporation (KFDC). This yard is made of concrete-floored plots and sheds (Figure 7). Malpe fishing harbor also has a dedicated drying yard spread over an area of about 5 acres, and this yard is usually leased to the Malpe Fisherwomen’s Cooperative Society. Field visits indicate that the Malpe fish drying yard may not be operating at full capacity, and its very existence may be under threat due to competition from other sectors such as tourism. Given exorbitant real-estate prices and increasing demand for land on much of the Karnataka coast, any disruption in availability of land for drying would severely increase capital costs, thereby affecting dried fish supply. Maintenance of these yards leaves much to be desired in all the coastal districts.

Figure 7. The fish drying yard adjacent to the Tadadi fishing harbor.

4.4. Working capital/variable costs in dried fish production

Figure 8 shows the working capital, in this case variable costs, for dried fish operations, by landing center. These responses were sought on a per-day basis, for example, through the question, “Please mention the price paid by you for Working capital- Ice (per day)”. The y-axis of each facet in the figure has different scales. Raw material (fish) forms the largest component of the variable costs. On average, costs of raw material (fish) form about 77 percent of the total working capital, followed by salt (9 percent), labor (7 percent), transportation (5 percent), and ice (2 percent). Raw material costs are higher in Mangaluru (in Dakshina Kannada), Malpe, and Gangolli (in Udupi), thus indicating that Uttara Kannada may have comparative advantage in procuring fish for drying operations at a lower price. In addition, [5, Ramappa et al., 2022] highlight the role of migrant women laborers in dried fish processing. These migrant women act as relatively less expensive labor for the processors, and in return the laborers get a higher wage than what is available to them in their native places.

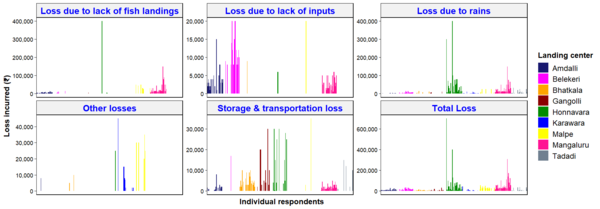

4.4. Losses in dried fish operations

Dried fish production, like any activity dependent on wild capture fisheries, is subject to risks and uncertainties which could lead to substantial losses. Unpredictable fish landings could hamper timely availability of raw materials. Moreover, dried fish producers of Karnataka follow the traditional sun-drying method to remove moisture from the fish[5]. Thus, weather plays an important role in their business. In addition, there will be product degradation and damage during transportation and storage. Therefore, there are numerous factors that could lead to physical or product losses and thus economic loss in the dried fish business.

Figure 9 shows the economic losses incurred by the respondents due to different sources, by landing center. It is noteworthy that respondents at Mangaluru and Malpe, two largest fishing harbors of Karnataka, report losses due to lack of fish landings, while such losses are less prevalent at other landing centers. Loss due to lack of inputs is reported mostly in Amdalli, Belekeri, and Mangaluru. Small losses due to rains are reported from most landing centers, but some such instances of loss are quite big in Honnavara and to a lesser extent Mangaluru. Therefore, untimely rains can lead to severe financial shocks for dried fish processors. On average, among the sources of loss considered in this study, the biggest component in the total loss is the lack of raw or fresh fish (about 58 percent of total losses), followed by lack of inputs (26 percent), while untimely rains and losses in storage and transportation result in about eight percent loss each.

Figure 8. Working capital in dried fish operations, by source of costs, and by landing center.

Figure 9. Economic losses in dried fish operations, by source of loss, and by landing center

4.5. Seasonality in dried fish production

Weather patterns in the coastal districts of Karnataka can be classified into the following seasons:

- The dry season: December to February. The weather is hot and humid in the dry season, but not as much as in the summer season.

- The hot and humid summer season: March to May

- The monsoon season: June to November (encompassing the southwest monsoon- Mungaru in Kannada- that lasts from June to August; and the southeast monsoon- Hingaru in Kannada- that lasts from October to November).

Of course, there may be untimely rains in a year, and such events are believed to be becoming more common over the years. There is no real winter in the coastal stretch of Karnataka.

Figure 10 shows the best seasons for dried fish trade in the opinion of the respondents. Most respondents agree that summer is the best season for dried fish trade. This is because the peak fishing season in Karnataka coast is in November-December, and fish catch declines gradually in the subsequent months, reaching a minimum in peak summer. Therefore, with fresh fish availability being lower, demand for dried fish increases in the summer.

In the first round of the surveys, the respondents were asked to state the best months and the worst months for trading of dried fish and for procuring of fresh fish. Most respondents feel that the Dry season and the monsoon season are the worst for dried fish trade. This is again due to the market impacts of fresh fish availability. The dry season is when marine fish harvest is at its peak and hence there is lower demand for dried fish in the market. This also means more fresh fish is available in the dry season for dried fish operations. In the monsoon season there is a ban on fishing by boats having 10 horsepower engine or higher, and hence there is short supply of raw fish for dried fish operations, which also makes the monsoon season less suitable for procuring fresh fish for dried fish production.

4.6. Marketing of dried fish

Table 16 shows the marketing channels used by the respondents. The Table shows that processors often use more than one marketing channel to sell their output. Selling to local traders, followed by direct selling, are two of the most common marketing channels used by the respondents. There are some respondents who sell to traders from the hinterland (the Western Ghats) areas of Karnataka. Most of the "other channels" mentioned by the respondents, in response to an open-ended question, could be classified as variants of direct marketing.

Table 16. Marketing channels used by respondents: No. of respondents using different channels.

| Direct selling | Sell to up-ghat traders | Sell to local traders | Sell to

restaurants |

Selling through other channels |

|---|---|---|---|---|

| 145 | 56 | 222 | 8 | 20 |

Direct selling of dried fish to consumers can be expected to take more time and effort from the processors, than selling to local traders. Probing deeper about direct selling mechanisms, Table 17 shows that most respondents do not usually use their own vehicle for direct selling. In fact, hired vehicles are usually used for transporting dried fish in direct sales, and an equal number of respondents use public transport or go on foot for direct selling.

Table 17. Usual mode of transportation used by respondents in direct sales of dried fish.

| Mode of transportation | No. of respondents using |

|---|---|

| By foot | 71 |

| Using bus or other public transport | 71 |

| Using hired vehicles | 110 |

| Using own vehicle | 14 |

Most respondents travel 5km or more when selling directly to consumers. Given that they do not usually use their own vehicles while selling directly, they are vulnerable to shocks such as COVID-19 or climate shocks (increased temperature and untimely rains) that can hamper the marketing activities of the sellers.

Figure 14. Direct selling of dried fish: maximum distance traveled by respondents for selling.

Most respondents sell to an equal mix of urban and rural consumers (Figure 15). Most processors work by selling from a designated spot in the marketplace, while also working as hawkers (Figure 16).

Figure 15. Direct selling of dried fish: location of consumers.

Figure 16. Direct selling of dried fish: selling mechanism.

Figure 17 shows a word cloud generated from the text analysis of responses to a question that asked the respondents to describe the parameters used by the buyers/consumers of their product when buying dried fish products. A word cloud is an image containing words in which the size of each word in the cloud indicates its frequency or importance. It is often used as a descriptive tool to capture basic qualitative insights. Figure 17 shows that the respondents have used words more frequently in the context of hygiene and organoleptic qualities. In the opinion of the respondents, some of the important attributes considered by consumers are[6]: price of the dried fish; species of dried fish; hygienic conditions of drying and marketing; and, sensory quality attributes such as the smell, salt content (presence of salt layer), physical damage; and texture. Therefore, this word cloud can be taken to imply that the respondents are aware of the hygiene-related qualities in dried fish products desired by their customers. It is also worth noting that there is no mention of any words related to packaging.

Figure 17. A word cloud representing the most frequent words associated by consumers when they buy dried fish, as recalled by respondents.

4.7. Perceptions about the dried fish profession

The respondents were asked if they would like to continue to work in the dried fish business. The responses, shown in Figure 18, indicate that an almost all the respondents would like to continue in the dried fish business.

Figure 18. Willingness of the respondents to continue in dried fish profession.

A recent study by [5] on Karnataka’s dried fish segment indicated that there may be question marks over succession and continuity of dried fish processing in Karnataka. That is, younger generation of the traditional fisher communities may not be interested in continuing their parents’ profession especially dried fish processing. Continuing on this topic, the respondents were asked if their children would like to continue their parents’ profession which is also a family business passed on from generations. Figure 19 shows that only 33 respondents said a definite yes to the question, 147 responded ambiguously (Maybe), and 84 responded with a definite no. The highest number of yes answers were from Tadadi (11), Bhatkala (8), Amdalli (7), and Mangaluru (5). The highest number of no answers were from Gangolli (25), Mangaluru (16), Karawara (12) and Malpe (10).

Figure 19. Perceptions of the respondents about the willingness of their children to continue in dried fish business.

The respondents were also asked if they thought the younger generation was interested in professionally taking up fish processing and drying. Responses shown in Figure 20 indicate that there are substantially more no answers (72) than yes responses (27), with most responses being a maybe (163). Most yes answers were from Bhatkala (12) and Amdalli (7). The highest number of no responses were from Mangaluru (18), Tadadi (12), Karawara, Malpe and Belekeri (9 each), and Gangolli (8).

Figure 20. Perception of the respondents about the willingness of the younger generation to take up dried fish business.

The respondents were asked to state their main motivation when entering the dried fish business. As shown in Figure 21, only 27 respondents entered the dried fish business seeking to exploit a business opportunity. Following the classification generally used in the study of entrepreneurial motivation, these can be termed the “opportunity-driven” entrepreneurs who create business when they see an opportunity, while all the other respondents can be termed “necessity-driven” entrepreneurs who take up business when no other opportunities are available to them [6, Li, Huang and Song 2020].

Figure 21. Motivation for the respondents to enter dried fish business.

The survey touched upon the demand-related issues of dried fish marketing, particularly demand barriers. Figure 22 shows the different barriers to dried fish demand and the ratings assigned to them by the respondents. Among the major perceived barriers are the price of the product, its shelf-life, difficulties in preparation, preparation time, and scarcity.

The survey asked the respondents to rate the importance of some variables determining quality in the fish drying process. Figure 23 shows the responses, in which a rating of one (1) indicates no importance and five (5) indicates highest importance. Drying duration and method are considered most important by highest number of respondents. Some of the other important variables are related to hygiene and sanitation (water quality, drying yard, storage and transportation, and infestation). Air temperature is the least important variable for the respondents.

Figure 22. Barriers to the demand for dried fish and their ratings provided by the respondents.

Figure 23. Perceptions of the respondents about some selected dry-processing quality variables and their importance.

Most of the respondents were not positive about adopting solar drying for producing dried fish (Figure 24). Only 42 of the 271 respondents replied a definite yes when asked if they are willing to adopt solar drying, compared to 111 who responded with a definite no, and 117 who were not sure. Most of the yes responses were from Gangolli (26) and Bhatkala (9). Most no answers were from Karawara (30), Amdalli (26), and Mangaluru (22). Among those saying not sure, most were in Honnavara (27), Belekeri (24), Bhatkala (20), and Malpe (16).

Figure 24. Willingness of the respondents to adopt solar drying.

When asked if they had plans to expand their dried fish opearations, 70 respondents said yes, only 28 said no, and 169 were undecided (Figure 25). Among those who said yes, most were from Tadadi (25), followed by Bhatkala (15) and Gangolli (14).

Figure 25. Willingness of the respondents to expand their dried fish business.

The surveys asked the respondents a series of question to state their perceptions about the past and the future of dried fish business. Firstly, they were asked if the size/scale of their dried fish business had grown or declined or remained the same, compared to the time of starting the business. As shown in Figure 26, very few (i.e., 34 out of 271) responded that their business had expanded over the years; 83 felt that their business had remained almost the same; and, 109 felt that their business had declined over the years. Karawara (11), Bhatkala and Tadadi (7 each) had the highest number of respondents who stated their business grew. Among those saying their business had declined over the years, most were from Amdalli (27), Mangaluru (26), and Honnavara (20).

Figure 26. Perceptions of the respondents about the growth of their dried fish business over the years.

Figure 27 shows that most respondents (131 out of 271) feel the demand for dried fish has definitely increased compared to the time they started their business. Only 42 respondents believed demand had decreased from the time they started business, and 54 believed there was no change in demand over time. Among those saying demand had increased, most are from Amdalli (30), Bhatkala (27), Tadadi (22), Mangaluru and Karawara (20 each). Of those who said demand had decreased, most were from Belekeri (18) and Malpe (13). Among those who said there was no change in demand, most were from Honnavara (15), Belekeri (11), Gangolli and Mangaluru (9 each).

Figure 27. Perceptions of the respondents about trends in demand for dried fish over the years.

The respondents were asked how availability of raw fish has changed for drying compared to the time when they started their business. As Figure 28 shows, most respondents feel that it has become more difficult to procure raw fish over the years (204 of 271), 40 respondents feel that availability of raw fish has remained almost the same, and only 7 respondents feel that availability has increased.

Figure 28. Perceptions of the respondents about the availability of raw fish over the years for dried fish operations.

Respondents were asked about their perceptions of the future of dried fish business. These responses are on a Likert scale of one (1) to five (5) where 1 indicates strongly disagree; 2 indicates agree; 3 indicates neither agree nor disagree (neutral); 4 indicates agree; and, 5 indicates strongly agree. Figure 29 shows the responses to these questions. When asked to respond to the statement that the demand for dried fish will increase in the next five to ten years, 117 of the 271 respondents gave a rating of 4; 83 respondents gave a rating of 3; 37 respondents gave a rating of 2; and 31 respondents gave a rating of 5. Thus, about 55 percent of the respondents are optimistic (i.e., ratings of 4 or 5) about the demand for dried fish increasing in the future. There is almost the same pattern of responses for the price of dried fish in the future. About 57 percent of the respondents feel optimistic, and about 32 percent are neutral.

Figure 29 shows that respondents are not optimistic about the availability of raw fish for dried fish operations in the future. About 60 percent of the respondents do not agree with the statement that “the availability of raw fish for dried fish production to increase over the next five to ten years”. About 28 percent are neutral about this statement.

In response to the statement that “I expect a bright future for the dried fish business in the next ten years”, 52 percent of the respondents were neutral, 28 percent were optimistic, and about 20 percent were not optimistic. In Bhatkala, 21 respondents gave a rating of 5 and eight respondents gave a rating of 4, indicating more optimism. Malpe (13), Tadadi (10), and Mangaluru (9) are some other markets where comparatively more respondents were optimistic. In contrast, 23 of the 30 respondents in Belekeri gave a rating of 2 indicating lack of optimism.

Figure 29. Perceptions of the respondents about the future of dried fish business.

The respondents were asked to rate their agreement about some threat factors for the dried fish business. Three of these factors were related to the competition for raw material (fish), i.e., interstate fish traders, fishmeal and fish oil (FMFO) industry, and fish processing plants. The ratings were on a scale of 1 to 5 where 1 indicates strongly disagree; 2 indicates agree; 3 indicates neither agree nor disagree (neutral); 4 indicates agree; and, 5 indicates strongly agree. Figure 30 shows the responses for each of these threat factors. From Figure 30, it can be generalized that the respondents do not feel threatened by the interstate fish traders, but feel relatively more threat from FMFO and fish processing plants.

- There are more respondents who do not agree that interstate fish traders pose threat to their dried fish operations. About 48 percent of the respondents gave a rating of either 1 or 2, indicating their disagreement about the threat posed by interstate fish traders. About 29 percent of the respondents gave a rating of either 4 or 5 indicating their agreement

- Regarding threat posed by competition from the FMFO industry, about 52 percent of the respondents gave a rating of either 4 or 5, indicating agreement. About 23 percent showed disagreement by giving a rating of 1 or 2, while about 25 percent were neutral. Respondents in Amdalli (30), Mangaluru (27), Malpe (21), Tadadi (18), and Gangolli (17) were more among those showing agreement.

- Responses for the question on threat from fish processing plants follow closely to those for the FMFO. About 51 percent gave a rating of either 4 or 5 indicating agreement about the threat; about 22 percent responded with a rating of 1 or 2; and about 27 percent were neutral. Amdalli (30), Malpe and Tadadi (23 each), Mangaluru (21), and Bhatkala (16) were the markets where more respondents showed agreement.

Finally, declining fish stocks and climate change are two factors that respondents feel pose the most serious threat to their dried fish operations. About 76 percent of the respondents gave a rating of either 4 or 5 for declining fish stocks, whereas for climate change it was about 81 percent.

Figure 30. Perceptions of the respondents about some factors as a source of threat to their dried fish operations.

4.8. Impacts of COVID-19

Impacts of the COVID-19 pandemic were strongly felt during the time of the surveys. Therefore, the survey instrument contained questions to capture the impacts of COVID-19 on dried fish processors. Two sets of questions were included. The first set of questions pertained to the impacts on the fisheries operations of the respondents, while the second set of questions included the impacts on their daily life. Figure 31 shows the responses to the questions about impacts on fisheries operations. These questions asked the respondents to rate the impacts respondents felt during COVID-19 compared to normal times. About 71 percent responded that supply of fresh fish declined during COVID-19 compared to normal times. About 60 percent of the respondents felt that the demand for dried fish increased during COVID-19, and about 68 percent felt that the price of dried fish increased during COVID-19. Compared to dried fish, the responses show a stronger increase in demand for and the price of fresh fish. About 82 percent of the respondents felt that the demand for fresh fish increased during COVID-19 and about 85 percent felt that the price of fresh fish increased.

Figure 31. Impact of COVID-19 on fish processing operations.

The second set of measures of COVID-19 impact were adapted from the scale developed by [7, Stoddard et al., 2023] for measuring the purpose. The original scale asks 12 questions on different issues such as daily life, hosehold income, and access to food. The scale assigns a score to each question that ranges from 0 (zero) to 3 (three), where zero indicates no impact; 1 indicates mild impact; 2 indicates moderate impact; and, 3 indicates severe impact. For each question, a verbal description is given separately to explain the scores. Only three questions that were more suitable for the Karnatka context were selected from [7, Stoddard et al., 2023]. Figure 32 shows the response to these questions. Overall, very few respondents gave a rating of zero, which indictes that there was at least some impact of COVID-19 on dried fish processors.

- In terms of access to food, about 28 percent of the respondents felt mild impact, 48 percent felt moderate impact, and 23 percent felt severe impact. Among those reporting a score of 3 (severe impact), more were from Tadadi (22), Gangolli (20) and Malpe (11).

- In terms of impact on daily life, 25 percent felt mild impact, 41 percent felt moderate impact, and 33 percent felt severe impact. Among those reporting a score of 3 (severe impact), more were from Amdalli (30), Gangolli (27) and Tadadi (9).

- In terms of household income, 25 percent of the respondents felt mild impact, 37 percent felt moderate impact, and 37 percent felt severe impact on routine. Among those reporting a score of 3 (severe impact), more were from Amdalli (30), Gangolli (24) and Tadadi (21).

Thus, in terms of overall severity of impact, COVID-19 had more severe impacts on the daily life and household incomes of the respondents.

Figure 32. Impact of COVID-19 on some aspects of daily life of the respondents.

Discussion

This report presents the findings from the only comprehensive study on the dried fish production market of Karnataka. The study improvised the data collection procedure to overcome the destructive impacts of the COVID-19 pandemic on the state and was able to collect detailed data on dried fish producers and their operations in Karnataka’s three coastal districts. A total of 271 dried fish processors were interviewed thrice to understand their socioeconomic and demographic profile, operational details in the different seasons (post-monsoon, monsoon, and pre-monsoon), and their perceptions about various issues related to dried fish processing.

A key contribution of this study is in detailing the socioeconomic and demographic profile of dried fish processors. Survey results show that women play a predominant role in dried fish processing in Karnataka. A typical dried fish processor in coastal Karnataka is a Hindu woman, poorly educated, aged 30 years or more, living below the poverty line, mainly belonging to the Other Backward Classes, and her household depends mainly on fisheries for its livelihood. Typically, she lives in a pucca house of either concrete or tiled roof, with a monthly income of ₹30,000 or less, and a family size of six or less. A typical dried fish processor in Karnataka is economically weaker than the general marine fisher population of the state as revealed by comparison with the BPL numbers from MFC-2016.

Auctions and direct purchase from boat owners are the two most important methods used by dried fish processors to get raw fish for drying. In beach landing centers, processors may also purchase fish from commission agents or use the fish harvested by family members for drying. A majority of processors feel that it has become more difficult over time to get raw fish for dried fish operations.

Mangaluru is the largest dried fish production center, as can be inferred from the quantity of fresh fish procured for dried fish operations. It has a share of about 30-35 percent in the total dried fish production volume of the nine markets. Mangaluru has been historically a major center of dried fish trade, including inter-state trade. Mangaluru is also a populous city with a dedicated wholesale market as well as a retail market for dried fish. Therefore, ready access to markets for the outputs could be a major factor for the large share of Mangaluru. Given that much of the dried fish production in Mangaluru takes place close to Mangaluru town, it is significant that this production market is still able to produce largest quantities of dried fish despite the acute real-estate shortage in urban Mangaluru and other related constraints.

In terms of fish species used in drying, anchovy and mackerel are the two top species by volume procured. Each of these two fish have a share of about 20-40 percent in total dried fish production volume. Some other important types include croakers, flatfish, scads, lizardfish, and ribbonfish. Anchovy and mackerel are procured in every location in substantial quantities in all three seasons. For other fish types, there are at least some locations and/or seasons of low production.

Some of the major capital costs for the processors are those on baskets/boxes, drying materials, knives, and tarpaulins. In terms of variable costs in dried fish production, the cost of the raw material (fresh fish) constitutes over three-fourths of the total variable costs. Unavailability of fresh fish is also the major source of economic loss for the processors. Moreover, processors feel that availability of fresh fish for drying is likely to decrease in the future.

Comparing the three rounds of the survey, the largest procurements occurred in the post-monsoon round, followed by the monsoon round, with the least procurements taking place in the pre-monsoon round. Procurements in the pre-monsoon round are lower by 56 percent relative to those in monsoon season, and lower by 39 percent compared to the post-monsoon round. Pre-monsoon season is a lean period in terms of fish landings, and hence supply of fish for dried fish operations is limited in these months. Even though climatic factors such as temperature and absence of rains in the pre-monsoon season are conducive for dried fish production, reduced supply of fresh fish acts as a constraint for production. Almost all landing centers show substantial reductions in procurements in the pre-monsoon round except for Malpe and Bhatkala. However, this exception is likely due to relatively lower procurements in the other two rounds at these two locations. Particularly severe reductions are seen in Belekeri, Honnavara, Karawara, and Amdalli in the pre-monsoon season.

Dried fish markets exhibit strong seasonality which is linked to the supply of fresh fish. Summer is the best season for selling dried fish whereas lower sales are seen in the cool-dry months. In contrast, procuring raw fish is difficult in the summer and peak monsoon months when mechanized fishing is banned in coastal Karnataka.

In terms of marketing, the processors use mainly two channels to sell dried fish: sale to local traders and direct marketing. Most fisherwomen processors travel at least 5 km for direct selling to consumers, even though most do not own a vehicle. Thus, direct marketing takes much physical effort and there is a high opportunity cost of labor. The processors are also vulnerable to uncertainties introduced by dependence on public transportation and to extreme weather events which are becoming increasingly common.

Looking at dried fish producers as entrepreneurs, the study finds that most can be considered necessity-driven entrepreneurs. That is, they are forced by circumstances to start dried fish business due to factors such as lack of other opportunities. Some of the findings of this study regarding the perceptions about dried fish business can be understood from an entrepreneurial angle. For example, it is not surprising that many processors’ business has not grown over the years, especially in the absence of policy support. Most of them responded with a no when asked if they were interested in expanding their business. Given that the coastal districts of Karnataka are attracting large investments in tourism, industries, logistics etc., there will be a greater diversity of employment opportunities for the younger generations in fisher communities. Therefore, with increased educational levels in the coastal districts, there may be fewer from the community taking up dried fish processing and marketing. This may affect the market structure of dried fish segment such that there will be fewer processors left in the market once the current cohort of processors retires.

Conclusions and Recommendations

Dried fish processing and marketing is widely considered to be an essential part of small-scale fisheries of tropical countries. In coastal Karnataka the dried fish value chain is characterized by the predominant role of women belonging to traditional fisher communities, apart from involvement of migrant women laborers. Thus, it can be argued that the dried fish value chain supports the livelihoods of economically and socially backward sections of society. However, since fisheries is commonly viewed from a fishing perspective which is a male-dominated activity, the role played by women in fisheries often gets underappreciated.

This neglect in Karnataka for small-scale fisheries in general and women-centric fisheries activities in particular is evident from the absence of government programs – state government or central – aimed at promoting the welfare of small-scale fishers. Governmental programs are aimed at promoting industrial fishing and ignore coastal small-scale fisheries, including traditional activities such as dried fish processing and marketing. In most cases, these traditional activities do not even appear in official documents. In the absence of policy support, there is a danger that these traditional activities could fade out of the fisheries sector altogether. The lack of interest among the younger generation of coastal fisher communities in inheriting and continuing the dried fish operations from their elders may be indicative of a repercussion of policy apathy. Given that dried fish serves as a nutrition-dense food in Karnataka, especially for consumers belonging to marginalized sections, a decline in dried fish production could disrupt food and nutrition security in regional food systems, apart from eroding the livelihood options of traditional fisher communities.

Lack of secondary data on dried fish production and consumption was a key limitation observed during the preliminary research for this report. There is hardly any reliable and consistent secondary data on dried fish production and consumption in the state. The economic surveys conducted by government agencies should specifically collect data on the dried fish segment, not aggregate it together with the general seafood sector.

In view of the discussions presented above, the following recommendations are made to revitalize the processing and marketing of fish segment of Karnataka’s seafood sector:

- The study finds that dried fish processing and marketing supports the livelihoods of thousands of small-scale fishers in coastal Karnataka. Drying is a cost-effective and environment-friendly method of preserving fish that produces nutritionally dense products. Moreover, dried fish has been increasingly seen as an excellent solution to the malnutrition problem. Therefore, policymakers in Karnataka should favorably treat the dried fish segment of Karnataka’s seafood value chain. For example, India’s Blue Economy policy has made provisions to encourage “low carbon fisheries”, and the dried fish segment appears to have a clear advantage over other fish processing techniques in terms of carbon emissions. Government should introduce new welfare programs that are designed for the traditional small-scale fisher community. Budgetary allocations for these programs must be made in accordance with the number of traditional fishers operating in each taluk.

- In addition, the academic community should bring out more nuanced studies on issues related to nutritional value (nutritional profile; ways to increase nutritional contribution), processing technology (comparing the carbon emission profile of different fish processing technologies; small-scale and sustainable drying technology; factors affecting drying technology), and cultural and social roles of dried fish.